My tween children hooked me on the Netflix sci-fi drama-thriller, “Stranger Things,” which depicts a sleepy town in Indiana. The town experiences the unexplained disappearance of a young boy and the arrival of a young girl, Eleven, with psychokinetic powers. The boy’s disappearance is attributed to the secret portal to an alternate dimension, “The Upside Down,” which starts to subtly impact the town’s residents in disastrous ways while Eleven helps combat the dark side.

The ravaging effects of the Coronavirus are not paranormal, but our world has recently come to feel like an “alternate reality” of fear, pessimism, social distancing, and sheltering at home. Like the series, Coronavirus has metaphorically brought the global economy to “The Upside Down,” with the U.S. economy being the last mega-domino to fall. With schools, restaurants, bars, professional teams, and businesses shuttering their doors, and curfews and travel bans enforced, a level of distrust and fear pervades that is unprecedented among most of our contemporaries.

The family office structure is designed to withstand epic shocks, prepared for the once-in-a-century events like a pandemic. What have the best and brightest family offices done to prepare? They have created contingency plans, watched carefully global markets, and have looked for “triggers” to implement various investment, liquidity, business risk management, and family strategies. The following reflects on what family offices are doing or can do to get through this “Upside Down” period.

Risk Tolerance: Know Your Pain Threshold

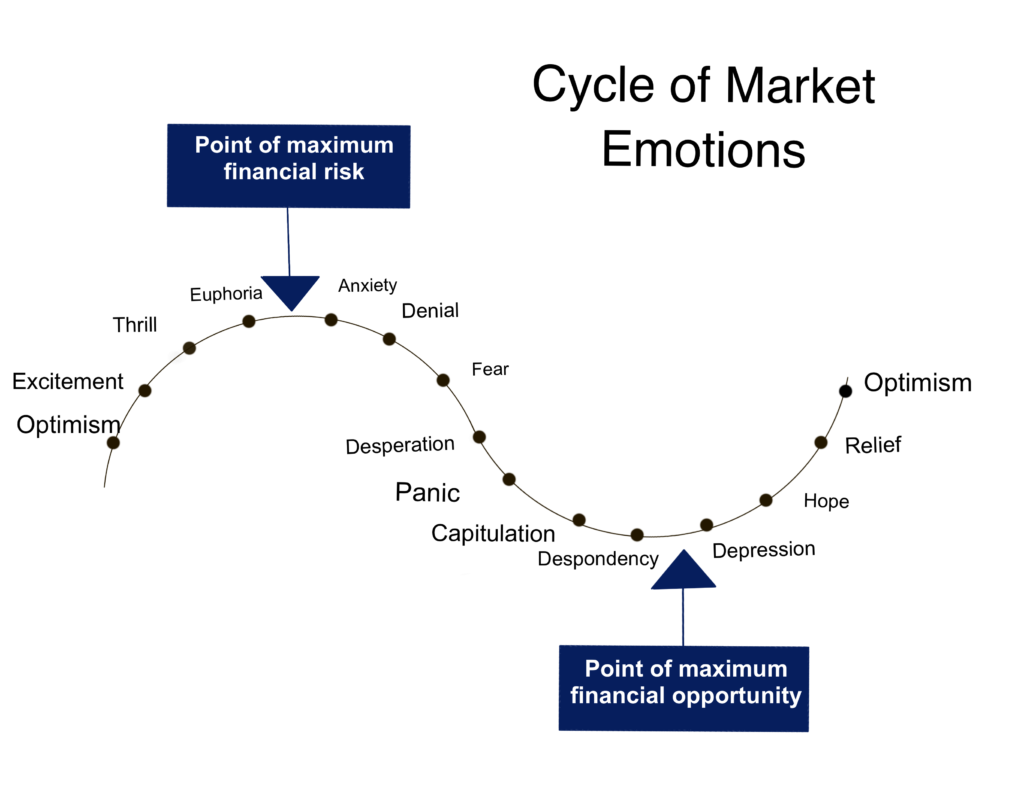

In the late ‘90s during the tech bubble and Y2K, I was a trader in a brokerage firm. Trading large blocks of securities for hedge funds and family offices and supporting the management of a series of private equity funds, I quickly identified my volatility pain threshold. Behavioral Finance in those days was in its infancy, but I lived firsthand the emotional rollercoaster now identified in the Cycle of Market Emotions investor curve.

Best-in-class family offices anticipate market cycles and are ready for corrective action when they see the triggers. Before this Black Swan scenario, many family offices had contingency plans in place, having answered questions such as:

1) What is the owner’s risk tolerance for a worst draw down?

2) How might the family react to sustained volatility in public equity markets?

3) What opportunities come with money trends – up or down?

4) How should a family office pivot their asset allocation during a Black Swan versus a normal period?

5) What criteria should I use to stress test my portfolio?

Sidelines and Patient Capital

One family office study illuminated that more than half (55%) anticipated entering a recessionary period in 2020. In preparation, many realigned their investment theses to mitigate risk (45%), increasing cash reserves and/or waiting for opportunities (42%).[1] Now that three years of gains have been erased in Q1 2020, how do we brace for what is to come? Will we find the bottom in the Spring, or will additional negative indicators drive the market lower? For many prudent investors, understanding the fundamental and technical triggers that signal when to invest or divest are critical. Some segments, such as transportation, travel, airlines, cruising, and entertainment may take years to recover. This new norm will fuel other industries, such as EdTech, medical, pharmaceuticals, healthcare, and technology. Shrewd family offices, with patient capital, will take the new reality of “Upside Down” and lever the dislocations, the volatility, and opportunities created by this new paradigm.

Hope and Possibility

Knowing most cannot time markets, I am bearish when investing during volatile times. What gives me confidence is focusing on the hope and possibilities during recovery. The family office is extraordinary with their impact investment strength as long-term, patient, and strategic investors. Many have shown true leadership by increasing their charitable efforts and are increasing giving personally and from their foundations from the minimum recommended distribution of 5% to higher levels (10+%). Jack Dorsey, Twitter and Square founder, committed nearly a third of his total wealth (28%) to make grants towards Covid-19 relief and to inspire others. “Why now? The needs are increasingly urgent, and I want to see the impact in my lifetime,” shares Dorsey.[2]

The coming months are a “work in progress;” from finding a Covid-19 vaccine, implementing the government’s stimulus package and distributing aid, to understanding the new education requirements for our schools, and caring for those who are isolated, ill, and managing the loss of loved ones, much is to come and to be done. Tolerance, grace, collaboration, leadership, and hard work will be key to our global recovery. The family office that is stress-tested, prepared, and opportunistic will be uniquely positioned to weather and eventually right the “Upside Down.”

[1] Campden UBS Global Family Office Report 2019

[2] To read more visit, https://www.nytimes.com/2020/04/07/technology/jack-dorsey-donate-1-billion-coronavirus.html

Cycle of Market Emotions, Adapted by Tamarind Partners

To learn more about Tamarind Partners visit www.TamarindPartners.com or contact Dr. Kirby Rosplock at Kirby@TamarindPartners.com.

Stranger Family Office Things

By Kirby Rosplock, PhD

Apr 15, 2020